DeFi's Great Reset: Why the Smart Money Is Betting on a 2026 Comeback

Okay, folks, buckle up, because we're about to dive into something really interesting happening in the DeFi space right now. I'm seeing a narrative emerge that's far more nuanced than just "crypto winter," and it's got me genuinely excited about what 2026 holds. So, you know that October crash that sent shivers down everyone's spines? Yeah, the aftershocks are still being felt, no doubt. FalconX's report paints a pretty stark picture: most DeFi tokens are still struggling, down an average of 37% this quarter. Ouch.

The Emergence of Strength Amidst Downturn

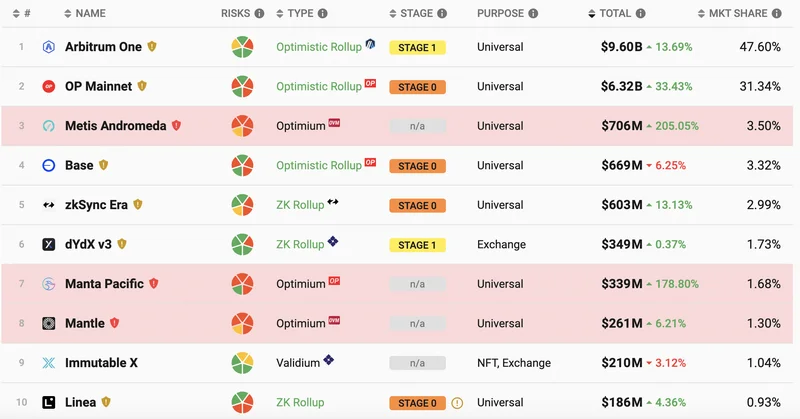

But here's where it gets interesting. It's not a uniform downturn; there are pockets of serious strength, glimmers of hope that tell a story of a market re-evaluating itself, figuring out what really matters. It's like after a forest fire, you see the first sprouts pushing through the ash, and those sprouts? They're showing us where the real resilience lies. What I'm talking about is a divergence, a "striking dichotomy," as Crypto Long & Short: The Striking Dichotomy in DeFi Tokens Post 10/10 puts it, where some DeFi projects are not just surviving but thriving. Investors, even amidst the chaos, are making calculated bets, and their choices are speaking volumes.

The Flight to Quality (and Utility!)

What's driving this? Well, it seems like the "smart money" is flowing towards two key areas: projects with solid buyback programs and those with clear, fundamental catalysts. Think of it like this: in a storm, you want a boat that's not only seaworthy but also has a purpose – a reason to brave the waves. Tokens like HYPE and CAKE, with their buyback mechanisms, are essentially saying, "We believe in ourselves; we're putting our money where our mouth is." That's a powerful signal in a shaky market, isn't it? It screams confidence. And then you have names like MORPHO and SYRUP, outperforming their peers because they've weathered the storm better or found new avenues for growth. It’s like, they didn’t just survive, they adapted, becoming stronger in the process.

DeFi's "Internet Moment"

And here's where my brain really starts firing: this isn't just about short-term gains; it's about a fundamental shift in how we value DeFi. We're moving beyond the hype and the promises to a place where real utility, real resilience, and real community engagement are the drivers of value. This reminds me of the early days of the internet, when everyone was throwing money at anything with a ".com" at the end, and then the bubble burst, and suddenly, only the companies with actual business models and real customer value survived. DeFi is having its "internet moment," its reckoning, and what emerges on the other side is going to be something truly special. I think we are witnessing the birth of DeFi 2.0.

The Promise of a Decentralized Future

What does this mean for you, for me, for the future of finance? Well, imagine a world where decentralized lending isn't just a niche corner of the crypto world but a mainstream alternative to traditional banking, where you can earn higher yields on your savings, access loans without the red tape, and participate in a financial system that's truly open and transparent. That's the promise of DeFi, and it's a promise that's getting closer to reality with every project that weathers this storm and emerges stronger on the other side. Of course, with great power comes great responsibility. We need to ensure that these new financial tools are accessible to everyone, not just the tech-savvy elite, and that they're used for good, not for exploitation. It's a challenge, but one I believe we're up to.

DeFi's Next Chapter

So, what's the big picture here? The October crash was a wake-up call, a reminder that hype alone isn't enough to sustain a market. But it's also an opportunity, a chance to rebuild DeFi on a stronger foundation of utility, resilience, and community engagement. The smart money is already making its bets, and I, for one, am incredibly excited to see what 2026 holds. It's not just about surviving; it's about thriving, and it’s about building a future where finance is truly decentralized, accessible, and empowering for everyone. When I see these projects adapting, innovating, and building real value, it reminds me why I got into this field in the first place: to be a part of something that's changing the world for the better.

DeFi: The Phoenix Rises

It's time to stop focusing on the crash and start looking at the ascent. It's not about if DeFi will bounce back, but how—and the answer is in the projects that are building real, sustainable value, right now. That's where the future lies, and that's where the real excitement begins.