Solana (SOL) Price Prediction for 2025: A Data-Driven Analysis

The narrative around Solana (SOL) is relentlessly bullish. High throughput! Low fees! The "Ethereum killer!" But let's pump the brakes and see what the actual data tells us about its potential price trajectory in 2025. I'm not interested in speculative guarantees; I want to see the numbers.

Solana's Technical Capabilities: Examining the Core Argument

The core argument for Solana rests on its technical capabilities. It’s fast, processing, according to some sources, over 1,000 transactions per second (TPS) with near-constant uptime. That's the headline. The less-advertised detail is that this performance comes with elevated hardware requirements for validators. Multi-core CPUs, large memory, high disk I/O – the kind of infrastructure that isn't cheap. While validators are geographically diverse, they're concentrated in regions with robust data centers – North America and Western Europe, primarily. This isn't inherently bad, but it does raise the barrier to entry and potentially concentrates power among well-capitalized operators. Is it truly decentralized if only certain entities can afford to play?

Solana's Tokenomics: A Closer Look

The tokenomics also deserve a closer look. SOL functions primarily as a utility token – transaction fees, staking, ecosystem participation. This is good. Utility-driven demand is far more sustainable than hype-driven pumps. About 60% of the allocation is earmarked for community/staking rewards, which is designed to incentivize long-term holding and network security. And about 70% of the supply is currently staked. The stated annual inflation is around 8%, but that's gradually decreasing. The high staking rate effectively reduces the circulating supply, providing some market stability. However, if network adoption stalls, that inflationary issuance could easily offset any short-term gains. It's a delicate balance.

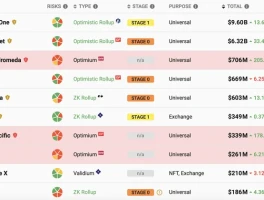

DeFi and NFT Activity: A Deeper Dive

The Solana ecosystem boasts a diverse range of applications. DeFi protocols hold a total value locked (TVL) of around $5.1 billion. Lending, borrowing, and liquidity farming dominate, indicating robust financial activity on-chain. NFTs account for another $1.2 billion, and these NFT launches trigger TPS spikes, which can be both a good and bad thing. It proves the network can handle high demand, but it also exposes its scaling limits. There are also over 350 active dApps. But the thing that I find genuinely puzzling is the correlation between SOL and other cryptos, especially Bitcoin and Ethereum.

Correlation with Bitcoin and Ethereum: Understanding Market Influence

The correlation with BTC is 0.72; with ETH, it's 0.68. What that tells me is that SOL's price is heavily influenced by broader market trends regardless of its internal network fundamentals. It's not operating in a vacuum. A market-wide crypto downturn will drag SOL down, even if its TPS remains high and its fees remain low. This is a critical point that many bullish narratives conveniently ignore.

Regulatory Environment: The Impact on Solana's Future

And what about the regulatory environment? The SEC's stance on DeFi participation will directly impact institutional investment in Solana. MiCA regulations in Europe could introduce stricter compliance requirements for token issuance. Licensing requirements in the Asia-Pacific region will affect staking, exchange listings, and liquidity provision. Regulatory clarity generally boosts confidence, while uncertainty suppresses adoption and trading volumes. Institutions, in particular, are highly sensitive to compliance.

The Verdict: Data vs. Hype

Let's consider a few scenarios. In a "base" case – sustained TPS, staking adoption, moderate macro stability – SOL might trade in the $135-$160 range in 2025. In a "stress" scenario – market-wide crypto downturn, temporary regulatory uncertainty – that range drops to $110-$135. Looking further out, from 2026-2030, a sustained stress scenario could see a price of $150-$200. 15 Cryptocurrency Forecasts For 2025 (Updated)

These aren't pie-in-the-sky predictions. They are data-driven estimates based on network activity, adoption trends, and protocol performance. They acknowledge the influence of external factors like regulation and macroeconomic conditions. They are a far cry from the hyperbolic claims that often dominate the crypto conversation.

The Numbers Don't Lie

Solana has potential. It's a fast, efficient blockchain with a growing ecosystem. But it's not immune to market forces or regulatory headwinds. The data suggests a more tempered outlook than the hype would have you believe.