[Generated Title]: Bitcoin's Wild Ride: From Treasury Darling to Discounted Asset - What Happened?

Okay, so everyone was patting themselves on the back about Bitcoin treasury companies, right? Genius move, they said. Ride the crypto wave to untold riches, they said. Now? Crickets. Turns out, financial engineering only works when the numbers go up. Who knew?

[H2] The Hype Unravels

Let's be real, the whole Bitcoin treasury thing was built on hype. Galaxy Research called it a "liquidity derivative," which is just a fancy way of saying it worked as long as people were willing to pay extra for the idea of owning Bitcoin through a stock. It's like buying a designer label on a plain t-shirt – you’re paying for the brand, not the cotton.

And now that Bitcoin's taken a tumble from its ridiculous highs – I mean, $126k? Give me a break – those premiums have evaporated faster than my patience with Elon Musk's Twitter antics.

The article says "The macro backdrop has turned increasingly risk-off." Translation: people realized putting all their eggs in one volatile basket is, shockingly, a terrible strategy. This isn't rocket science, folks.

[H2] The Perils of Triple Leverage

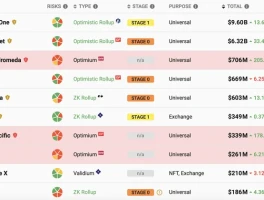

These Bitcoin treasury companies – Strategy (MSTR), Metaplanet (3350.T), Semler Scientific (SMLR), and Nakamoto (NAKA) – they all played the same game. Issue stock, buy Bitcoin, watch the stock price soar, repeat. It was a beautiful, self-destructive cycle.

But as Galaxy Research pointed out, it was all built on a house of cards. Operational, financial, and issuance leverage... it's like a triple shot of espresso before running a marathon. You might feel great for a few miles, but you’re gonna crash HARD. And that’s exactly what happened. Nakamoto, down 98%? Ouch. As DAT’s All, Folks? What’s Next for Bitcoin Treasury Companies points out, the leverage involved created significant risk.

Unrealized profits turning into massive losses? That's not "innovation," that's just bad timing. Remember when Metaplanet was bragging about $600 million in unrealized profits? Now they're swimming in red ink. Serves ‘em right. Maybe they should have sold some Bitcoin when they were up instead of hording it like some digital dragon.

But wait, are we really supposed to feel sorry for these guys? Seriously?

[H2] Crypto Darwinism: Survival of the Fittest

The article lays out three possible outcomes, but let's be honest, it boils down to one thing: survival of the fittest. The companies that overextended themselves are gonna get eaten alive. Restructuring, acquisitions, bankruptcies… it's gonna be a bloodbath.

Strategy's building up a cash reserve is smart, I guess. But it also screams "we screwed up and need a Plan B." They're trying to convince everyone they’re playing the long game, but I see a company scrambling to cover its ass after a major miscalculation.

And this whole "optionality on the next cycle" thing? Please. It's just corporate-speak for "we're hoping Bitcoin goes back up so we can do this all over again." Color me skeptical.

I mean, offcourse, it's possible that Bitcoin will rally again. But are we really going to pretend that these companies learned anything from this debacle? They'll just repeat the same mistakes, because that's what happens when greed trumps common sense. Why Is The Crypto Market Up Today? offers a counterpoint, suggesting potential positive catalysts.

Then again, maybe I'm the crazy one here. Maybe I just don't understand the genius of leveraging a volatile asset with even more volatile financial instruments. Nah, I’m pretty sure I’m right.

[H2] The Inevitable Conclusion

The Party's Over, Idiots