Tom Lee's Crypto Predictions: A Dose of Reality

Tom Lee's at it again, huh? Another day, another outrageous crypto prediction. This time, he's saying Ethereum's hitting $62,000 in the next few months. And Bitcoin? Oh, that's going to $250,000. Give me a freaking break. It's like these guys just pull numbers out of their... well, you know.

The 1971 Moment? More Like a Midlife Crisis

Lee's comparing Ethereum's current situation to 1971 when the dollar went off the gold standard. He calls it Ethereum's "1971 moment," claiming it's a "structural transformation driven by real-world asset tokenization." Okay, let's unpack that corporate buzzword salad.

What he really means is he's trying to sound smart while hyping up a technology that still hasn't delivered on its promises. Real-world asset tokenization? Sounds fancy, but it's just a way to repackage the same old crypto dreams: stocks, bonds, real estate, all on the blockchain. The problem? Nobody actually uses it. Wall Street's "taking advantage" of it? Maybe a few firms are dabbling, but let's not pretend it's some kind of revolution.

And this "2025 will mirror that inflection point" nonsense? Is he just making stuff up now? It's like he's got a dartboard with random dates and price targets. Seriously, what metrics is he even looking at? What real-world adoption is justifying these insane numbers?

He says Ethereum's been range-bound for five years but is "beginning to break out." Has it, though? Or is he just hoping it has? He claims $3,000 is "grossly undervalued." Undervalued by whom? By Tom Lee's imaginary friends? Look, I'm not saying crypto is dead, but these kinds of hyperbolic statements are exactly why people think the whole industry is a joke.

Offcourse, it could go up, but the fundamental problem is that the crypto market is driven by pure speculation, not actual value. And that's a house of cards waiting to collapse.

Bitcoin to $250K? I'll Believe It When I See It.

Then there's the Bitcoin prediction. $250,000 "within a few months"? He's been saying this for ages. Remember when he was calling for $150,000-$200,000 by last January? How'd that work out?

I gotta be honest, I'm tired of these "experts" making these wild predictions without any accountability. They pump up the market, retail investors jump in, and then the whole thing crashes, leaving them holding the bag. And these guys? They just move on to the next shiny object, the next outlandish claim.

It's not just Lee, either. Cardano founder Charles Hoskinson is saying Bitcoin could hit $250,000 in 2026 if Microsoft or Apple get more involved. Okay, but what if they don't? What if the big corporations stay away, realizing it's all just a volatile mess?

Crypto commentator Jacob King called these predictions "fantasy price targets, always pulled out of thin air." I can't say I disagree. It's all "hopium" instead of facing reality.

I had a buddy who was really into all this stuff. He poured his savings into some altcoin based on a Reddit thread, and now he's driving for Uber. I tried to warn him, but he wouldn't listen. He was too busy dreaming of Lambos.

Technical Analysis: More Like "Technically Possible"

Some "technical analysts" are seeing "improving momentum" for Ethereum. They say it broke out of a "falling wedge" pattern. I don't even know what that means, and frankly, I don't care. It's all just tea leaf reading for nerds.

Sure, Ethereum could test $3,541, and then maybe $3,876. But it could also crash back down to $2,000 tomorrow. Technical analysis is just a fancy way of saying "I'm guessing."

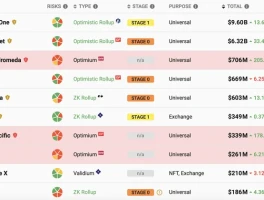

The problem? The entire financial services sector is a mess. Banks are shaky, asset management companies are bleeding clients, and insurance companies are... well, they're insurance companies. Crypto was supposed to be the answer, the decentralized alternative. But it's just become another playground for the same old Wall Street sharks, except with even less regulation. You can see the performance of financial service stocks Financial Services Stock Performance.

It's All Just a Big, Dumb Game

Tom Lee's predictions aren't about helping investors. They're about keeping himself relevant. It's about getting headlines, getting on TV, and selling his firm's research. It's a self-fulfilling prophecy: he makes a crazy prediction, people talk about it, and then he gets to say "I told you so" if it happens to come true. If it doesn't? He'll just make another one.

And honestly, maybe I'm just being cynical. Maybe Ethereum really will hit $62,000. Maybe Bitcoin will go to the moon. But I wouldn't bet my rent money on it.